The Only Guide to Hard Money Georgia

Wiki Article

Hard Money Georgia Things To Know Before You Get This

Table of ContentsThe Main Principles Of Hard Money Georgia What Does Hard Money Georgia Do?Fascination About Hard Money GeorgiaThe 30-Second Trick For Hard Money GeorgiaNot known Details About Hard Money Georgia

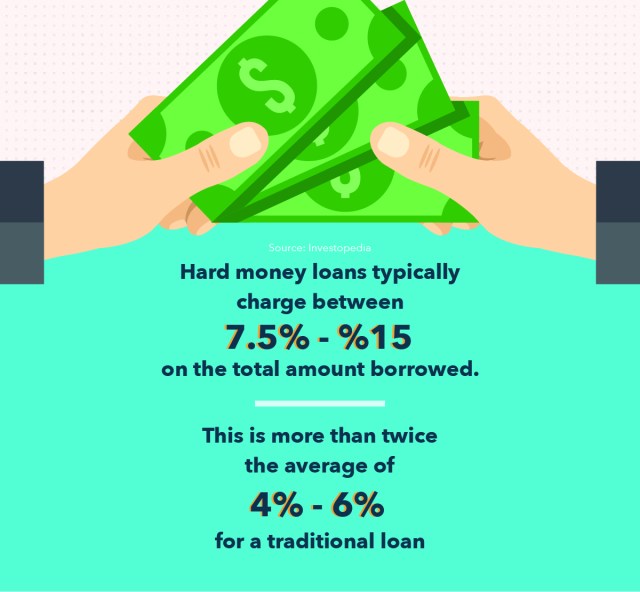

, are short-term financing tools that genuine estate financiers can make use of to finance an investment task.There are 2 key downsides to take into consideration: Hard money fundings are hassle-free, yet capitalists pay a rate for obtaining this means. The price can be up to 10 percent factors higher than for a traditional finance.

As a result, these financings feature much shorter settlement terms than standard mortgage lendings. When selecting a tough cash lending institution, it's important to have a clear suggestion of exactly how soon the residential property will come to be successful to ensure that you'll be able to pay back the funding in a timely way.

The 30-Second Trick For Hard Money Georgia

Again, lenders might enable financiers a bit of leeway below.Tough money finances are a great suitable for rich financiers that need to get financing for an investment property quickly, without any of the red tape that supports bank financing. When examining difficult cash lenders, pay very close attention to the fees, passion prices, as well as finance terms. If you finish up paying way too much for a tough money car loan or cut the settlement duration as well brief, that can influence how lucrative your property venture remains in the long run.

If you're wanting to buy a home to turn or as a rental residential property, it can be testing to obtain a conventional mortgage. If your credit rating isn't where a standard lending institution would certainly like it or you need cash money much more quickly than a lending institution is able to give it, you might be out of good luck.

Facts About Hard Money Georgia Uncovered

Difficult money loans are short-term protected financings that use the home you're buying as security. You will not discover one from your bank: Difficult cash fundings are used by different loan providers such as specific financiers as well as personal business, who usually ignore average debt ratings and also various other monetary elements and instead base their choice on the property to be collateralized (hard money georgia).

Tough money loans supply several advantages for debtors. These include: From begin to finish, a difficult money loan could take just a couple of days.

While difficult cash lendings come with benefits, a debtor has to also think about the threats - hard money georgia. Amongst them are: Hard cash lenders usually charge a higher rate of interest price due to the fact that they're thinking more risk than a conventional lending institution would certainly.

Hard Money Georgia Fundamentals Explained

You're unclear whether you can go afford to settle the tough cash loan in a brief time period. You've obtained a solid credit rating and ought to be able to get approved for a typical lending that most likely brings a reduced rates of interest. Alternatives to tough money loans include traditional home mortgages, residence equity finances, friends-and-family financings or financing from the building's seller.

Getting My Hard Money Georgia To Work

It is essential to think about factors such as the loan provider's credibility as well as rates of interest. You might ask a trusted actual estate representative or a fellow house flipper for recommendations. As soon as you've pin down the best hard money lending institution, be prepared to: Come up with the down repayment, which typically is heftier than the down repayment for a standard home loan Collect the needed documentation, such as evidence of income Potentially hire a lawyer to discuss the regards to the finance after you have actually been approved Map out an approach for settling the funding Equally as with any type of finance, evaluate the advantages and disadvantages of a tough cash car loan prior to you dedicate to loaning.Despite what type of lending you pick, it's probably a good suggestion to inspect your complimentary credit rating as well as cost-free credit history report with Experian to see where your financial resources stand.

When you hear words "tough cash finance" (or "exclusive cash car loan") what's the initial point that goes via your mind? Shady-looking lending institutions who conduct their service in dark streets as well as cost overpriced rates of interest? In prior years, some negative apples tainted the difficult cash lending market when a couple of predatory lending institutions were have a peek at this site trying to "loan-to-own", supplying extremely risky fundings to customers using property as security and also meaning to seize on the residential properties.

Report this wiki page